Life Insurance in and around Nashville

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

When you're young and just starting out in life, you may think Life insurance is only for when you get old. But it's a great time to start thinking about Life insurance to prepare for the unexpected.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Agent William Hardin, At Your Service

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With a protection plan from State Farm, you can lock in fantastic costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent William Hardin or one of their wise representatives. William Hardin can help design coverage options for the level of coverage you have in mind.

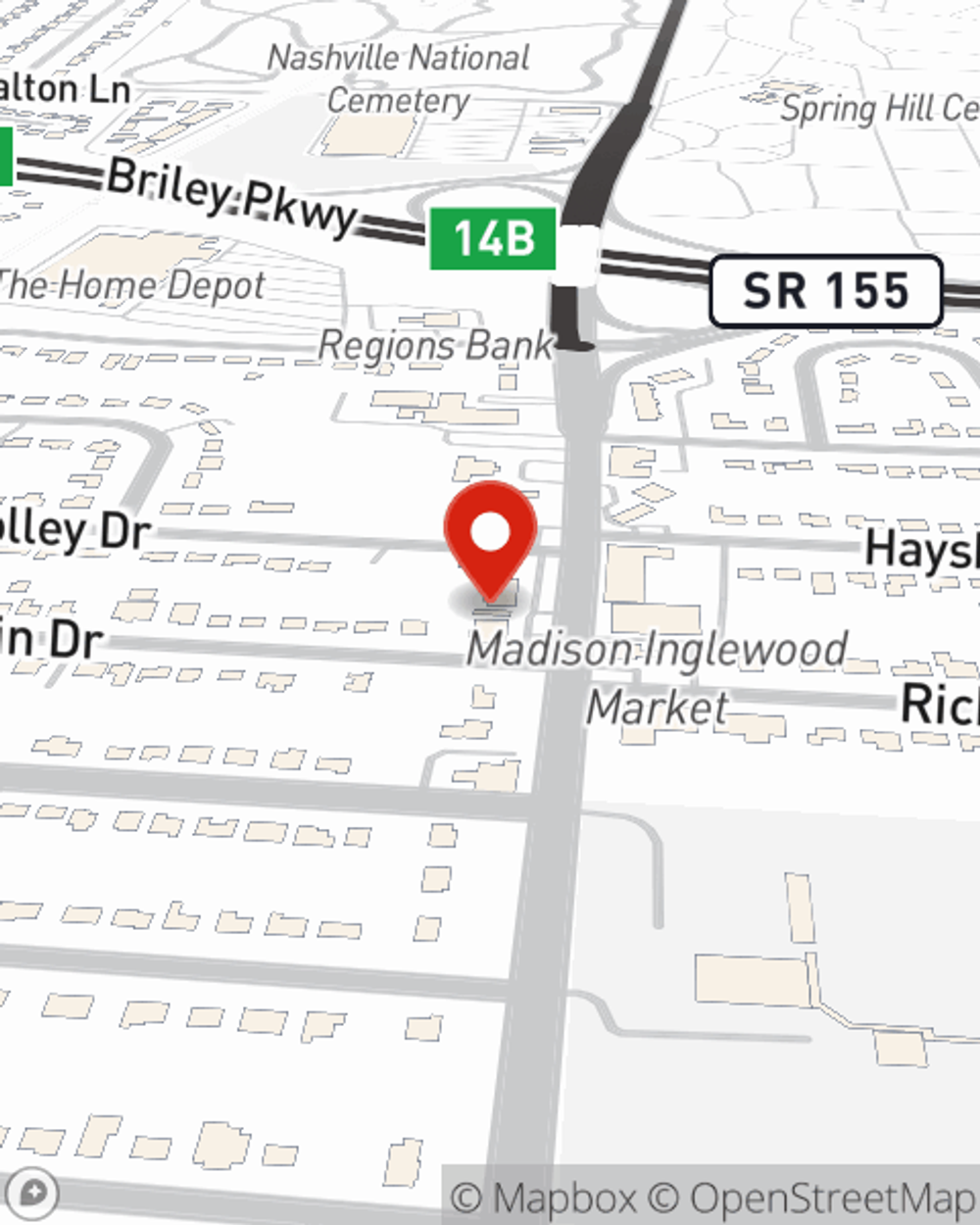

As a commited provider of life insurance in Nashville, TN, State Farm is committed to protect those you love most. Call State Farm agent William Hardin today and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call William at (615) 922-6382 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

William Hardin

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.